- Top

- Turnpoint Media

- Mobility Industry Trends

- Explore by Latest Data] Market Situation of Foreign Automakers|Market Share and Ranking by Country

モビリティ業界動向

Explore by Latest Data] Market Situation of Foreign Automakers|Market Share and Ranking by Country

2024.05.28

2025.06.20

Need help with your job search?

Consultation

- I don't know if there is a job that fits my criteria

- I don't have time to look for jobs.

- I want to start thinking about career planning.

Turnpoint Consulting is a recruitment agency specializing in the automotive and mobility industry. Our industry experts will support you in your career.

Table of Contents

This article explores the latest market shares of each manufacturer based on passenger car sales in Japan, the U.S., and China.

The automotive industry involves countries from all over the world, and the nationalities of manufacturers vary widely. It is a well-known fact that manufacturers from Japan are popular worldwide, but foreign manufacturers are also trusted and in demand. Specifically, how much market share do these manufacturers have in Japan? And how are they doing in overseas markets?

We explore the above trends based on data from the top 10 manufacturers in terms of sales volume in 2023. We hope this helps you understand the latest industry situation.

Imported Car Maker Share Ranking in the Japanese Domestic Market

FY2023 (Apr. 2023 – Mar. 2024) Maker Share of Total Japanese Market

Japanese manufacturers dominate the Japanese automobile market.

In 2023, 4,051,101 new vehicles will be sold in Japan. Of these, 244,844 units were sold by import car makers, a decrease of 0.5% from the 246,196 units sold in the previous year. Imported car makers accounted for 7.6% of the total, indicating that their share of the total is very limited.

While many foreign brands have automobile production plants around the world, there is not a single production facility of a foreign manufacturer in Japan. Therefore, all foreign-brand vehicles sold in Japan depend on imports. The following graph takes a closer look at the share of imported vehicle brands.

Breakdown of import car makers

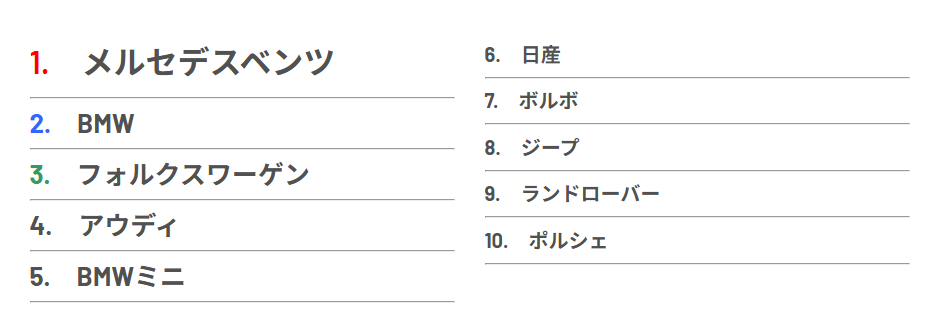

Import Car Maker Sales Ranking

German manufacturers such as Mercedes-Benz, BMW, and Volkswagen occupy the top five places in the imported car ranking, indicating their steady popularity. German manufacturers within the top 10, including Porsche in 10th place, account for about 70% of the total.

Nissan vehicles imported from overseas bases also account for a high percentage, and the popularity of Japanese manufacturers can also be seen in this way.

Maker Share Ranking in Overseas Markets

Next, let’s look at the share of manufacturers in the U.S. and China, the largest of the foreign markets.

American market

2023 (Jan-Dec) U.S. market

・Sales volume Maker share

Unit Sales Ranking

The number of passenger cars imported to the U.S. in 2023 will be approximately 5.8 million vehicles*¹, a stark contrast to the approximately 1.7 million vehicles*² produced in the U.S. in the same year. In particular, imports from Mexico (approximately 1.4 million vehicles), Japan (approximately 1.3 million vehicles), and Canada (approximately 1.1 million vehicles) were the largest, with these three countries accounting for 65% of all imported vehicles. *¹

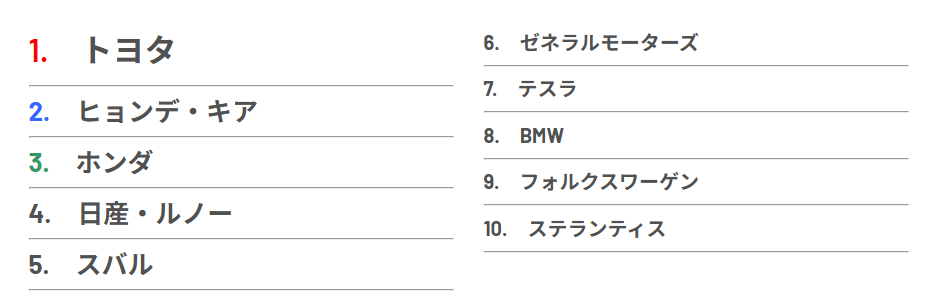

Looking at the actual breakdown of vehicles sold, Toyota, which has steadily pursued a hybrid vehicle (HV) strategy, holds the No. 1 market share, followed by Hyundai Kia, a Korean EV (electric vehicle) manufacturer. This is followed by Honda and other Japanese automakers, and the high market share of Japanese automakers in the United States is astonishing. General Motors, Tesla, and Ford are also ranked in the top 10 as U.S. domestic manufacturers, indicating their presence.

*: see INDEXBOX

*²: see Statista

China market

2023 (Jan-Dec) China market

・Vehicles produced in Japan Sales volume Maker share

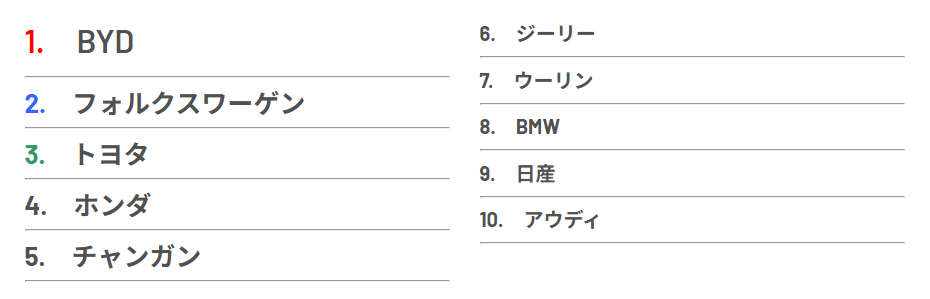

BYD, the largest EV manufacturer in China, holds the top market share, followed by Volkswagen and Toyota. The market share of Chinese manufacturers such as Changan and Geely is also high, while German manufacturers such as Volkswagen and Japanese manufacturers such as Toyota also hold market share, indicating that they are finding their way in the Chinese market.

Imported Vehicles Ranking

The percentage of imported vehicles in China continues to decline year after year, reaching a record low of 799,000 units in 2023.

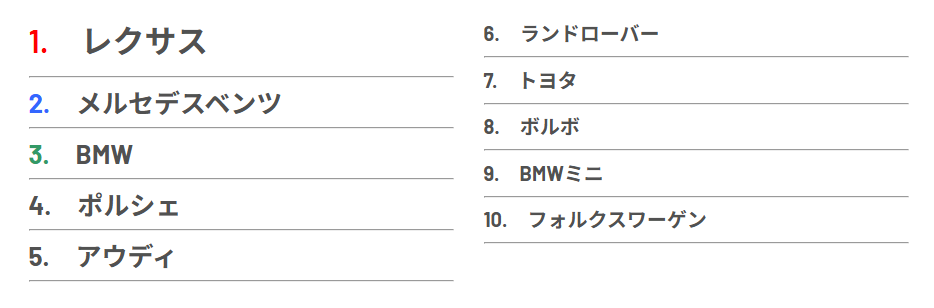

Below are the top 10 manufacturers. The top four manufacturers and BMW Mini, which ranked ninth, saw a decline in volume compared to the previous year, with BMW Mini in particular experiencing a severe drop of 36.3%.

The recent expansion of the new energy vehicle (NEV) market has increased consumer interest and reduced demand for conventional gasoline-powered vehicles, among other factors. Another factor is that luxury car brands that once relied on imports have begun to produce their vehicles in China in order to keep prices down, which is also putting pressure on the imported car market.

Maker’s share of domestic BEV sales in China in 2023

In addition, focusing only on the BEV market, the distribution is as follows.

Compared to the market as a whole, the overwhelming presence of BYD and other Chinese manufacturers stands out, and with the entry of major consumer electronics manufacturer Xiaomi into the EV market in April 2024, its share is expected to grow in the future.

Finally.

In addition to the sales (registration) volume and share by brand of foreign automakers in the Japanese market, we have also looked at their respective manufacturer shares in the U.S. and Chinese markets.

Japan has proven to be a very popular market for domestic automakers and a challenging and unique market for foreign automakers. Among imports, German manufacturers are very popular, but it will be interesting to see the future strategies of manufacturers from other countries.

The U.S. and Chinese markets also had their own distinct characteristics. More and more manufacturers are rapidly focusing on electrification, and the entire market is being challenged to further promote electric vehicles. It will be interesting to see what strategies each manufacturer will adopt for each market.

Understanding trends in the automotive industry can be very helpful when considering a career change, especially when researching companies and preparing for interviews. Turnpoint Consulting Turnpoint Consulting, Inc. is an agency specializing in the automotive industry, providing up-to-date and reliable information on the automotive and mobility job market and selection strategies for job seekers, as well as information on the talent flow in the industry for corporate recruiters.

Need help with your job search?

Consultation

- I don't know if there is a job that fits my criteria

- I don't have time to look for jobs.

- I want to start thinking about career planning.

Turnpoint Consulting is a recruitment agency specializing in the automotive and mobility industry. Our industry experts will support you in your career.

Supervisor of this article

Turnpoint Consulting Co.

Turnpoint Media Management Office

Turnpoint Consulting is a specialist recruitment agency for the automotive and mobility industry. Turnpoint Media will provide you with useful information on industry trends and career opportunities.

Related Articles

-

2025.06.21

Job Change x Trend News] Can’t Take My Eyes Off of You! Summary of the latest EV situation

-

2025.06.21

Gigacast is the key to EV manufacturing! Summary of companies introducing Gigacast

-

2025.06.20

Job Change x Trend News] By Manufacturer! Summary of the latest situation of self-driving cabs

Search by Industry

Consultation

Our expert team is dedicated to empowering your career change, crafting tailored career plans, and securing the best job opportunities in the automotive and mobility sectors.

- Top

- Turnpoint Media

- Mobility Industry Trends

- Explore by Latest Data] Market Situation of Foreign Automakers|Market Share and Ranking by Country