- Top

- Turnpoint Media

- Mobility Industry Trends

- Trend] Why EV Prices Are Falling|How Much Do BYD and Nissan Pay? How much are BYD and Nissan paying? Subsidy programs and market trends are also summarized.

モビリティ業界動向

Trend] Why EV Prices Are Falling|How Much Do BYD and Nissan Pay? How much are BYD and Nissan paying? Subsidy programs and market trends are also summarized.

2024.08.29

2025.06.21

Need help with your job search?

Consultation

- I don't know if there is a job that fits my criteria

- I don't have time to look for jobs.

- I want to start thinking about career planning.

Turnpoint Consulting is a recruitment agency specializing in the automotive and mobility industry. Our industry experts will support you in your career.

Table of Contents

This article will delve into the EV (electric vehicle) market with the theme of “vehicle price”.

EVs have an image of being more expensive than gasoline-powered cars, but in recent years, price reductions have been realized for a variety of reasons. This report explores the background, actual conditions, and factors that may provide clues to the further spread of EVs in the future. We hope this report will help you understand the latest EV situation and future industry trends.

Background of EV Price Decline

In recent years, the price of electric vehicles (EVs) has been rapidly declining. This is due to two major factors: technological advancements and increased market competition.

Technological evolution: reduction of battery costs and use of new materials

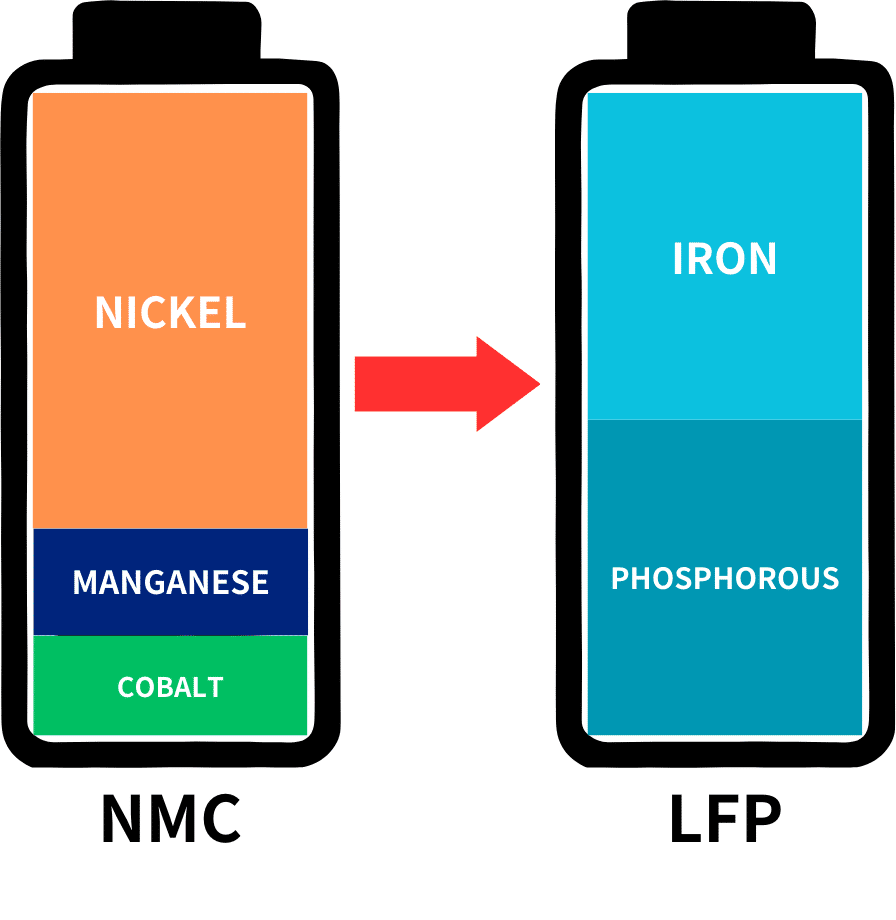

Advances in battery technology are driving the decline in EV prices. Of particular interest is the LFP (lithium-ion iron phosphate) battery. This battery has replaced the NMC (nickel-manganese-cobalt) battery that was the mainstay of conventional EV batteries and has enabled lower production costs. In particular, the Blade Battery, developed by BYD of China in 2020, achieves high energy density and overcomes the range issues that conventional LFP batteries had.

Overcoming these technological challenges has led to a steady decline in battery costs: according to a study by BloombergNEF (BNEF), battery prices in 2023 fell 14% year over year to an all-time low of $139/kWh; for EV battery packs only, even lower $128/kWh.

Furthermore, battery performance is also improving, with Toyota and Nissan moving forward with the mass production of all-solid-state batteries. This is expected to extend the cruising range of EVs and improve their ability to respond to rapid recharging.

Continued technological innovation is expected to simultaneously improve the performance and reduce the cost of EVs.

Price competition in the market: new entrants and increased competition

New entrants into the EV market and increased competition are also driving prices down. For example, BYD has successfully developed low-cost, high-performance EVs, and in the fourth quarter of 2023 overtook Tesla to take the top spot in sales volume. Inspired by BYD in the aforementioned battery development, other manufacturers, including Tesla, are also focusing on innovation.

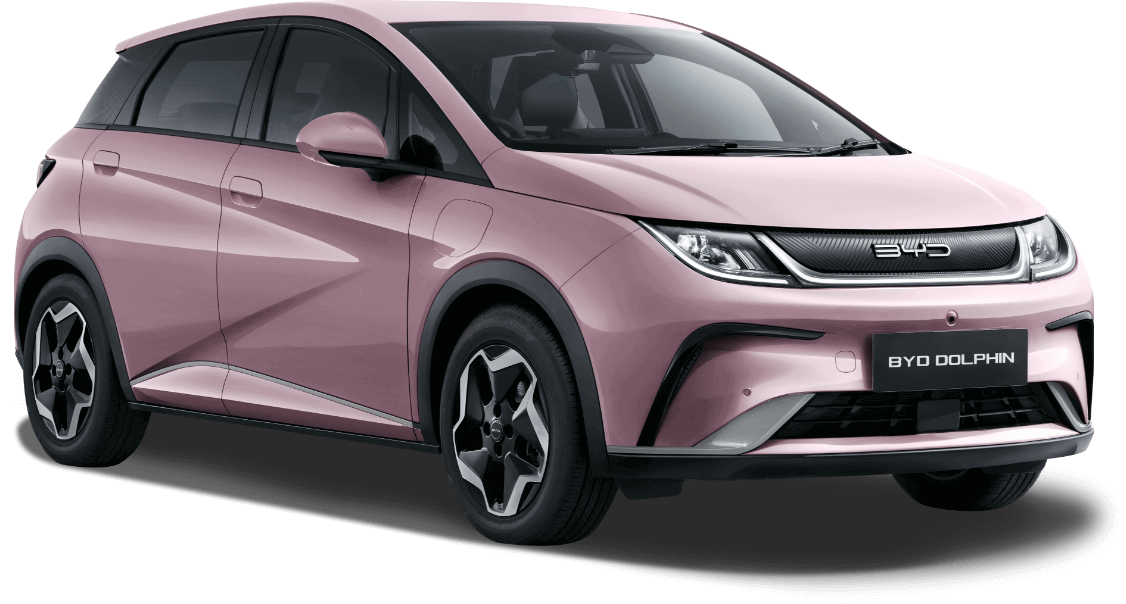

In the Japanese market, BYD’s compact EV “DOLPHIN,” launched in September 2023, has attracted attention with its low price* of from 3.63 million yen. Outside of Japan, Xiaomi, a major consumer electronics manufacturer, entered the EV market in March 2024, dominating the industry with its high-performance, low-priced model, the SU7.

The rapid increase in the number of car models as automakers promote the development of EVs is also driving price competition.

*As of June 2024.

Benefits and Challenges of Lower Prices

Benefits: Reduced burden on consumers and promotion

Lower EV prices will bring significant benefits to consumers: according to BNEF projections, the price of EVs could fall below that of gasoline-powered vehicles as early as 2025. More reasonably priced EVs for consumers will encourage purchases and further EV adoption.

In fact, data for 2023 show that EV sales grew even more, reaching 13.6 million units. This figure represents a 35% growth compared to 2022. Market expansion is also progressing in Japan, where the number of EVs (BEVs) sold in the country in 2023 increased by 50% over the previous year to approximately 80,000 units, and when combined with PHEVs, reached a record high of approximately 140,000 units.

Some observers are now suggesting that EVs may account for more than 30% of global new vehicle sales by 2030. *It is hoped that the decline in EV prices will further support this trend.

Related articles are here:

[Latest Version] The EV Market from the Basics|Current Trends in the World and Japan

2024 EV Market Outlook|HVs More Popular? What are the four trends that the industry is focusing on?

Disadvantages: pressure on manufacturers’ profits and impact on used car market

Even though manufacturers are working hard to develop low-cost, high-performance batteries, battery prices do not always follow a simple downward path. Prices can be temporarily higher due to input costs and market conditions. We need to watch carefully to ensure that complete vehicle manufacturers do not put pressure on their suppliers to keep product prices low.

The rapid decline in EV prices is also having a serious impact on the used car business. The combination of used vehicles currently on the market, plus price competition from manufacturers, has caused the value of used EVs to decline faster than that of internal combustion engine vehicles. In fact, as of October 2023, the price decline of used cars over the previous year was only 5% for the market as a whole, while the price of used EVs followed a decline of about 30%.

With regard to used EVs, the industry as a whole has not yet decided how to handle used EVs, such as the lack of an established battery quality evaluation method, and the used EV market has not developed. In any case, a significant drop in the price of used EVs could shake the profit structure of the industry as a whole.

Price Comparison: Domestic and Foreign EV Markets

In the Japanese domestic EV market, the emergence of light EVs has been particularly noteworthy. For example, the following two models are popular:

- Nissan “Sakura”: 2,599,300 yen and up

- Mitsubishi “eK Cross EV”: from 2,568,500 yen

These light EVs have a battery capacity of 20 kWh and a cruising range of 180 km, which is sufficient for daily use.

Source: Next-Generation Vehicle Promotion Center, Inc.

In addition, the following are considered to be the cheapest models among foreign-brand vehicles.

- BYD “DOLPHIN Standard Model”: from 3,630,000 yen

- Hyundai “KONA Casual”: from 3,990,000 yen

Source: BYD Auto Japan Co.

Source: Hyundai

Also, as a model that is not yet available in Japan and is expected to enter the market in the future,

- BYD “Seagull” estimated 1.5 million yen and up

- Hyundai “Instar” estimated at less than 3.38 million yen

- Xiaomi “SU7” estimated 4,520,000 yen and up

It is expected that there will be even more choices when purchasing EVs.

Subsidies and tax incentives for EV purchases

The Japanese government and local governments have each implemented support measures to encourage the widespread use of EVs.

Background of the subsidy system

According to the Next Generation Vehicle Promotion Center, the purpose of the subsidy is “to reduce harmful vehicle emissions that contribute to global warming and air pollution through the use of clean energy vehicles (CEVs).

One CEV and one use will not lead to a significant reduction in harmful gases, but such an objective will be achieved if many people use CEVs. In short, the significance of this subsidy program is to encourage consumers to purchase more EVs (electric vehicles) by lowering the purchase price.

Government support measures: subsidies, tax incentives

The government subsidy is called “Subsidy for Promotion of Clean Energy Vehicle Introduction (CEV subsidy).” Under the government EV subsidy for FY2024, regular EVs can receive a maximum of 850,000 yen, light EVs and PHEVs (plug-in hybrid vehicles) a maximum of 550,000 yen, and FCVs (fuel cell vehicles) a maximum of 2.55 million yen. FCVs (fuel cell vehicles) can receive a maximum of 2,550,000 yen.

It is important to note that the subsidy does not apply to clean diesel vehicles or HEVs (hybrid electric vehicles). In addition, some EV vehicles other than four-wheeled vehicles, such as electric minicars and mopeds, are also eligible for subsidies, so you will need to check accordingly when making your purchase.

Reference: Prepared based on the Next-Generation Vehicle Promotion Center, Japan, and Gulliver.

In addition, multiple tax incentives are currently available for the purchase of EVs, which, in addition to subsidies, are factors that further reduce the purchase burden. Specifically, there are three major tax incentives: the “Greening Special Exception” for automobile and light automobile taxes, the “Eco-car Tax Reduction” for automobile weight tax, and the “Environmental Performance Discount.

Each of these preferential measures is set to apply from the end of FY2025 to the end of April 2026, so it is important for consumers who are considering purchasing EVs not to miss this opportunity.

◇Region-specific benefits: Region-specific incentives

In addition to government subsidies, there are also subsidies from local governments. Depending on the region and conditions, subsidies of 1 million yen or more may be available for the purchase of EVs.

For details, please refer to the subsidy programs, loan programs, and special taxation measures of local governments nationwide.

Future EV Market Outlook

Technological Evolution and Market Trends

EV technology is evolving day by day. Particular attention is being paid to a production technology called “Gigacasting”.

<What is GIGACASTING? >

It is the latest large-scale casting technology in automotive manufacturing, which molds a large portion of a car body that used to consist of many parts into a single aluminum component.

Tesla in the U.S. has already introduced this technology in its flagship EV, the Model Y, replacing 171 steel plate parts with two giant aluminum parts. Gigacasting is revolutionizing the automotive industry by simplifying the manufacturing process, reducing the number of parts, and reducing the weight of the car body. The widespread use of this technology is also impacting the automotive parts supply chain.

Toyota Motor Corporation intends to use this technology for the front and rear of the vehicle body in its next-generation EVs. This is expected to make EVs cheaper to produce than gasoline-powered vehicles by 2027.

In addition, battery technology continues to evolve. Various technological innovations are expected, including the development of long-life batteries and the commercialization of all-solid-state batteries.

Market Growth Prospects / Initiatives through Government

The EV market is expected to grow in the future due to EV promotion activities by the government and government agencies, including subsidies.

There is also a trend to encourage the use and spread of EVs by using EVs in mobility services. Below is a list of measures to utilize EVs through collaboration between automobile manufacturers and local governments.

- Dennou Kotsu’s electric vehicle (EV) cab agency business newly introduced in Hiroshima Prefecture

- Earth hacks to join GREEN JOURNEY Promotion Committee, a consortium of 14 companies including Nissan Motor and Nippon Travel Agency to be formed through industry-academia-government collaboration.

Related article:

What is “MaaS” in the first place? Thinking about the future of mobility with service examples

While it is hoped that the diffusion of the system will be based on regions and lifestyles, it is expected that the speed of diffusion will vary from region to region due to differences in energy infrastructure and social conditions. It seems that an approach commensurate with local circumstances and needs is necessary.

Finally.

The declining price and technological evolution of EVs are bringing about major changes in the automotive industry. Continuous technological innovation and market competition are expected to make EVs more accessible in the future. Let’s continue to follow the latest information on EVs and catch up with the trends.

Understanding trends in the automotive industry can be very helpful when considering a career change, especially when researching companies and preparing for interviews. Turnpoint Consulting Turnpoint Consulting, Inc. is an agency specializing in the automotive industry, providing up-to-date and reliable information on the automotive and mobility job market and selection strategies for job seekers, as well as information on the talent flow in the industry for corporate recruiters.

Need help with your job search?

Consultation

- I don't know if there is a job that fits my criteria

- I don't have time to look for jobs.

- I want to start thinking about career planning.

Turnpoint Consulting is a recruitment agency specializing in the automotive and mobility industry. Our industry experts will support you in your career.

Supervisor of this article

Turnpoint Consulting Co.

Turnpoint Media Management Office

Turnpoint Consulting is a specialist recruitment agency for the automotive and mobility industry. Turnpoint Media will provide you with useful information on industry trends and career opportunities.

Related Articles

-

2025.06.21

Job Change x Trend News] Can’t Take My Eyes Off of You! Summary of the latest EV situation

-

2025.06.21

Gigacast is the key to EV manufacturing! Summary of companies introducing Gigacast

-

2025.06.20

Job Change x Trend News] By Manufacturer! Summary of the latest situation of self-driving cabs

Search by Industry

Consultation

Our expert team is dedicated to empowering your career change, crafting tailored career plans, and securing the best job opportunities in the automotive and mobility sectors.

- Top

- Turnpoint Media

- Mobility Industry Trends

- Trend] Why EV Prices Are Falling|How Much Do BYD and Nissan Pay? How much are BYD and Nissan paying? Subsidy programs and market trends are also summarized.